🏡 Understanding NRI Real Estate Investment Challenges in Hyderabad

Avoid Pitfalls, Protect Your Money, and Invest Smartly in India’s Fastest-Growing Real Estate Market

Hyderabad is booming. With infrastructure upgrades, mega projects like Future City, RRR (Regional Ring Road), Life Sciences Hub, and metro expansions, it's no surprise that Non-Resident Indians (NRIs) are eyeing this market for high-return investments.

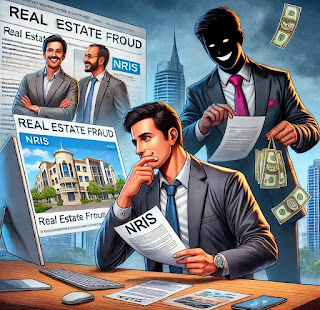

But here's the truth:

📉 Online information alone won't protect you from bad decisions.

💰 "Exclusive NRI Deals" are often red flags.

🛑 Fraud is real, and so are long-term losses.

Let's break down the real challenges NRIs face—and how you can invest wisely and securely in Hyderabad.

💡 1. Online Research Isn’t Enough

While YouTube videos, websites, and virtual tours can provide a snapshot, they often miss critical information:

-

Is the land in a growth zone or under litigation?

-

Is the project truly RERA-approved?

-

How reliable is the infrastructure development timeline?

👉 Hyderabad real estate is hyper-local. A prime plot in one lane may not hold the same value two streets down.

👣 2. Local Presence is Critical

Without physically being there—or appointing someone trusted—you won’t know:

-

Road connectivity and future development plans

-

Water table, soil quality, or nearby industrial pollution

-

Reality vs. marketing hype (brochures can lie!)

Recommendation: If your investment is ₹50+ lakhs or more, it deserves a 5-day personal visit.

🚨 3. "NRI-Only Deals" are a Red Flag

You might receive offers that say:

“Only for NRI investors!”

“100% ROI in 6 months!”

“Book online, we handle the rest!”

These play on trust and urgency. They’re often targeting NRIs who have no time to cross-check.

Remember:

🔒 Legitimate investments are the same for locals and NRIs.

📜 They don’t need gimmicks, just value and legal clarity.

✅ 4. RERA Registration is Just the Start

Check for:

-

Developer track record – Ask how many projects they’ve completed, not started.

-

FCDA / HMDA / DTCP Approvals – Insist on copies.

-

Encumbrance Certificate (EC) – To verify no legal disputes.

-

Layout approvals – Ask if it's a venture, gated layout, or farm land with zone clarity.

🧠 5. Seek Multiple Sources, Not One Sales Pitch

Don’t depend on the person who approached you.

🔍 Speak to independent Hyderabad-based legal advisors.

🔍 Get second and third opinions from other realtors.

🔍 Compare the same project’s price with nearby plots.

✈️ 6. Plan a Visit Before Finalizing

Many NRIs regret investing in ventures they’ve never seen.

-

See actual site conditions

-

Meet the developer

-

Evaluate nearby developments

-

Check roads, water, power availability

This single step can save you lakhs—or earn you crores.

💼 7. Test the Waters First

Even if the deal looks solid, start small:

-

Begin with 200-400 sq. yards.

-

Monitor how documents, registration, and updates are handled.

-

Judge transparency and speed of execution.

⚠️ 8. Share Real Fraud Examples

Many NRI-targeted scams follow this pattern:

-

Fake RERA number on brochure

-

Land without conversion approval sold as “farmhouse plots”

-

Price inflated for NRI buyers

-

No registration done even after full payment

Take these seriously. It’s not about fear—it’s about facts.

📋 Bonus: NRI Property Investment Checklist

✅ Confirm RERA & Layout Approval

✅ Verify ownership documents (Title deed, EC)

✅ Confirm zoning: Is it residential/agricultural/future growth?

✅ Visit site or send a verified representative

✅ Get legal verification through a Hyderabad-based advocate

✅ Ask for sale agreement draft BEFORE you pay anything

✅ Never make full payment upfront without registration commitment

🚀 Conclusion: Invest Smart, Not Blind

Hyderabad has incredible potential. But NRIs must exercise caution, not just excitement. With due diligence, local partnerships, and a strategic mindset, you can:

✔️ Avoid traps

✔️ Maximize returns

✔️ Become part of Telangana’s next growth story

Need trusted local guidance?

🔗 www.investmentplots.in

📞 WhatsApp: +919160759774

✈️ NRIs – Ready to Invest?

Ask yourself one last time: Am I investing based on reality or just a dream?

http://www.investmentplots.in

.png)

.png)

.jpg)